Last week, we had witnessed a decrease in value of dollar against euro and yen. Market traders dealing in Forex currency trading were hesitant in making any significant moves as the year 2015 comes to an end. The U.S. dollar index finished the trading day at 98.02 which indicates that it has lost 0.72% for the week.

The U.S dollar index basically monitors the performance of dollar against a group of six other currencies had drifted down. Furthermore, U.S. dollar decline had continued for more than one week after a rate hike was announced by the Federal Reserve earlier. By the end of week, U.S. Dollar lost 1 % against Euro, and EUR/USD settled at 1.0963. Moreover, US dollar had lost 0.66% against Yen and it settled at 120.78. This level was previously seen before the month of November 2015.

Moreover, economic reports that were published during the week showed that the economy grew by 2.0% during the third quarter. However, earlier it was anticipated that during the third quarter the economy will grew by 2.1% but it had fallen by 0.1%. In addition to, official statistics that were published during the week showed that core capital goods orders and its shipment had also seen a major decline which contributes towards business investment. Core capital goods lost 0.4% in the month of November while shipment lost by 0.5%.

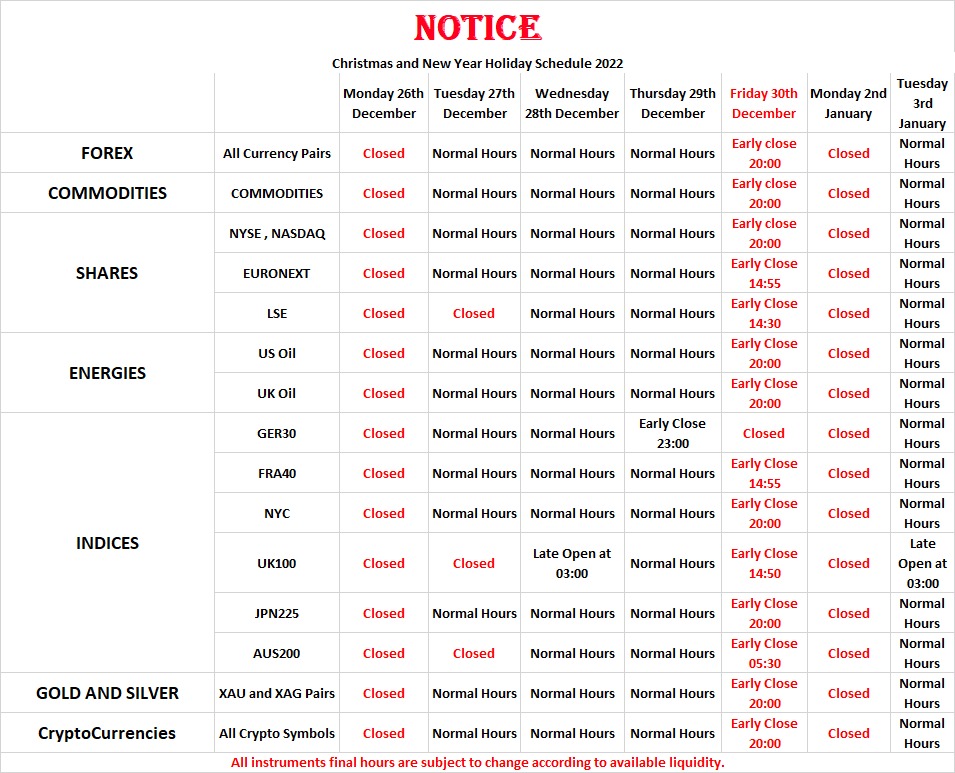

During the last week of December 2015 it is expected that Forex Currency Trading volumes will remain to be low as many of the Forex Currency Traders will be enjoying new-year and Christmas holidays therefore decreasing liquidity and enhancing volatility. Lastly, Forex Traders will be looking for Forex currency trading signals such as release of important statistics such as consumer confidence, home sales and unemployment claims that can give hints to them regarding the health of US economy and rate of hikes.