Trade Indices

Trade Indices

Gain exposure to an array of Equity Market Indices with Index CFDs.

| Instrument | Description | Average Spreads * | Minimum Lot Size | Maximum Lot size | Leverage * |

|---|---|---|---|---|---|

| AUS200 | Australian 200 | 8 | 0.01 | 1000 | up to 1:200 |

| ESP35 | Spain 35 | 11 | 0.01 | 1000 | up to 1:200 |

| EUSTX50 | Euro Stoxx 50 | 7 | 0.01 | 1000 | up to 1:200 |

| FRA40 | France 40 | 5 | 0.01 | 1000 | up to 1:200 |

| GER30 | DAX-Germany 30 | 5 | 0.01 | 1000 | up to 1:200 |

| HKG50 | Hong Kong 50 | 33 | 0.01 | 1000 | up to 1:200 |

| JPN225 | Japan Nikkei 225 | 13 | 0.01 | 1000 | up to 1:200 |

| UK100 | UK100 | 5 | 0.01 | 1000 | up to 1:200 |

| NAS100 | NASDAQ-100 | 3 | 0.01 | 1000 | up to 1:200 |

| SPX500 | S&P 500 | 1 | 0.01 | 1000 | up to 1:200 |

| US30 | Dow Jones Industrial Average | 5 | 0.01 | 1000 | up to 1:200 |

* Swap rates are calculated based on the Index Currency’s relevant interbank rate. Long positions are charged with the relevant interbank rate plus a mark-up and short positions receive the rate minus a mark-up. The operation is conducted at 00:00 (GMT+2 time zone, please note DST may apply) and can take several minutes. From Wednesday to Thursday swap is charged for three days

** Min. level for placing pending orders at a current market price.

The margin requirement for CFDs is calculated like this : Lots * Contract Size * Opening Price * Margin Percentage and not based on the leverage of your trading account.

The margin is always 50% when you hedge positions on CFDs and if your margin level is over 100%.

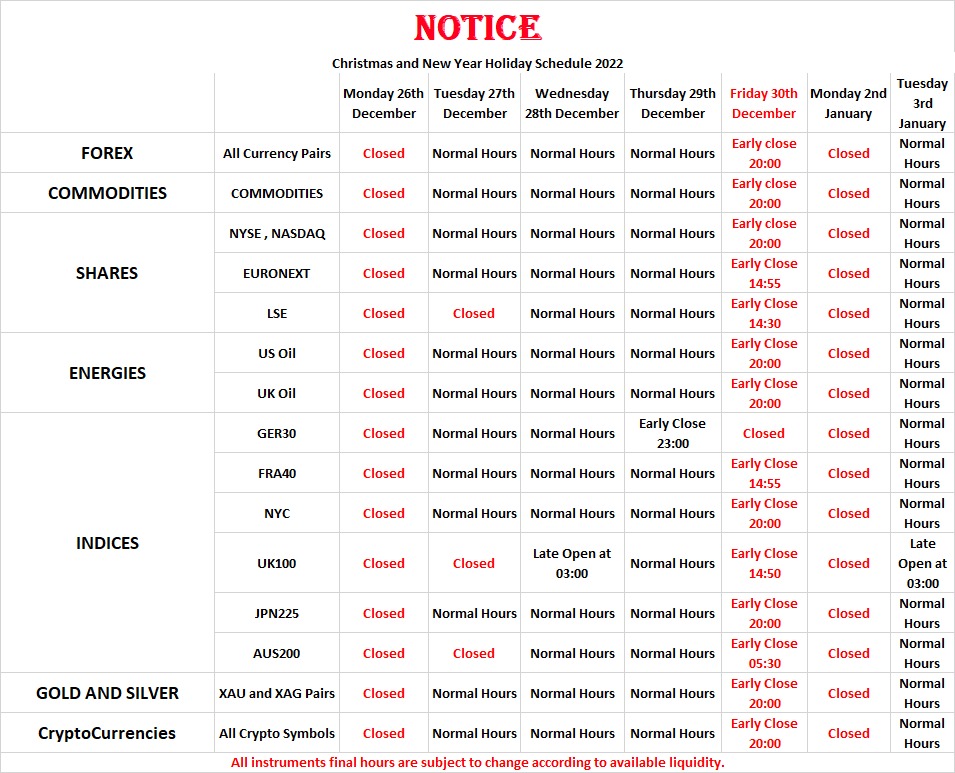

Calendar dates are indicative and are subject to change.

CFDs on Cash Indices will be subject to dividend adjustments. When a constituent member of an index pays Dividends to its Shareholders, dividend adjustments will be made to accounts of clients holding a position on the index at 00:00 (GMT+2 time zone, please note DST may apply) on the ex-Dividend Date. CFDs on Germany30 (GER30Cash) is not subject to dividend adjustments. CFDs on Future indices are also not subject to dividend adjustments.

Buy trades will receive an amount calculated as follows:

Dividend adjustment = Index Dividend declared x position size in Lots

Sell trades will bechargedan amount calculated as follows:

Dividend adjustment = Index Dividend declared x position size in Lots

| Symbol | Mon 24 Feb | Tue 25 Feb | Wed 26 Feb | Thu 27 Feb | Fri 28 Feb |

|---|---|---|---|---|---|

| UK100Cash | 27.732 | ||||

| AUS200Cash | 8.534 | 2.435 | 3.875 | 2.219 | 0.765 |

| JP225Cash | 15.859 | ||||

| US30Cash | 6.443 | 4.748 | 18.617 | ||

| US500Cash | 0.417 | 0.066 | 0.021 | 0.667 | 0.425 |

| HK50Cash | 73.727 | ||||

| US100Cash | 0.054 | 0.129 | 0.68 | 0.129 |